Twenty-nine years ago, the Dow Jones Industrial Average plunged a gut-wrenching 508 points, or 22.6%, down to 1,738.74 on what is now referred to as Black Monday.

It was by far the largest one-day percentage drop in US stock market history.

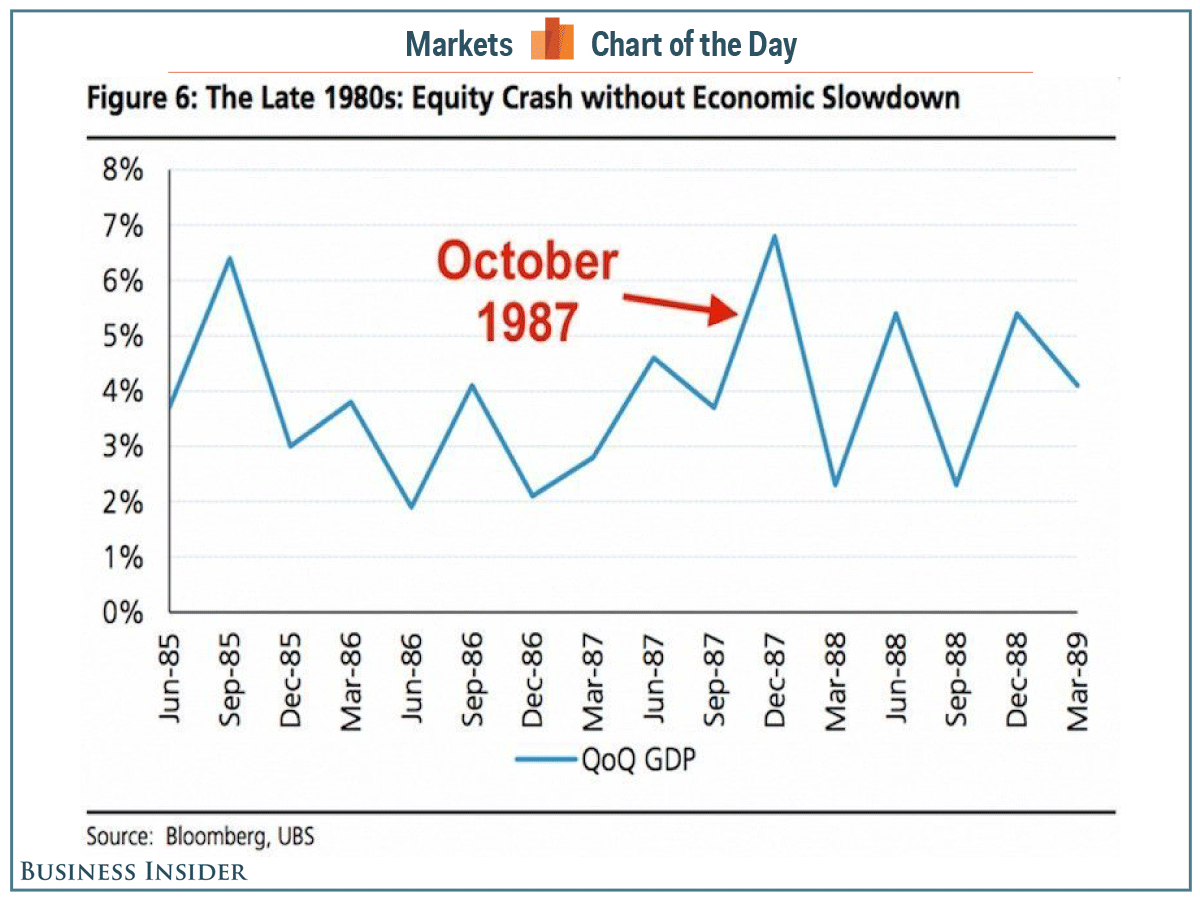

But as scary as that October day was, US economic growth was ultimately resilient, and gross-domestic-product growth never went negative. This is arguably the most important thing to remember about the whole ordeal.

Now, that’s not to say the stock market has no effect on the economy. Indeed, a huge sell-off could slow the economy and even lead it into a recession.

But experts don't consider downturns triggered by stock market crashes to be among the worst kinds of recessions.

Last year, Lombard Street Research's Dario Perkins compared the effect on GDP from both the dot-com stock market crash of 2000 and the subprime-mortgage crisis of 2007-2008. GDP continued to rise during the former, but it got slammed in the wake of the latter.

Going back to stocks, it's encouraging to remember the stock market didn't die that day. The Dow is up about 16,377, or 940%, in the past 29 years.